Fed Clueless About Stubborn Inflation & What To Do To Get Rid Of It

Remember when you Treasury Secretary Janet Yellen told you inflation was just temporary?

Or when she told you to go out and spend money to stimulate the economy after government lockdowns flattened the economy during the Covid 19 pandemic?

Suffice it to say that was a couple of years ago.

Federal Reserve Chairman Jerome Powell has paved the way for 7% mortgage interest rates, and much higher rates on car loans and credit cards, with a series of interest rate hikes the past couple of years.

You were told the higher interest rates were intended to dissuade you from spending, so the economy would cool down.

How has that been working out? Not so well Ma’am.

Today a report from the U-S Labor Department is not good. It will show the feds are not making much progress at all against inflation.

And if you have tried to buy anything lately, well, you know what prices are like.

The consumer price index measures costs for a wide-ranging shopping basket of goods and services and will show slight increase in prices for all items sold, and for energy and food.

The Fed is now infamous for constantly repeating its mantra of working to get inflation down to 2%. Right now, it is at 3.4% for all items. 3.7% for food and energy. In baseball parlance, that would be called a swing and a miss, as the batter badly misses a fastball right down the plate.

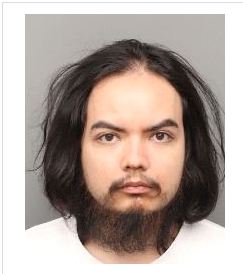

Economy graph: green rising arrow and dollar bills.

Photo from Alpha Media Portland OR